Can you make money stock trading online different ways of getting paid

More from Entrepreneur. Day trading is known for losing people lots of money as well as being stressful, so it is usually better to invest over a long period of time. You can easily find current stock price quotes on sites like Google Finance Items That Make Money On Ebay Dropshipping Sites Yahoo Finance. Some websites such as ScottradeELITE, SureTrader and OptionsHouse offer a virtual trading platform, where you can experiment for a while to assess your instincts without putting actual money in. When you begin investing in stock, it's important to understand how you might actually be able to make money from owning the stock; to intimately have a grasp on how the increase in wealth is generated for you assuming you've selected your position wisely. That's a gamble you don't want to take if you're not a seasoned investor, says John Carter from Simpler Trading. Already answered Not a question Bad question Other. There are 22 references cited in this article, which can be found at the bottom recurring commission affiliate marketing audience size the page. If you make more than a certain amount of trades per week, the Security Exchange Commission SEC forces you to set up at institutional account with a high minimum balance. The blue-chip stocks never show this type of volatility that is required for short-term trading profits. Consider putting a portion of your profits into a savings or retirement account. Before picking a service, read through user reviews and BBB ratings, if available, to confirm that the website is reputable. Stocks are intangible assets that give you ownership in a company. The hard part is choosing the right one. Invest in. Oh heck naw!!! That won't happen.

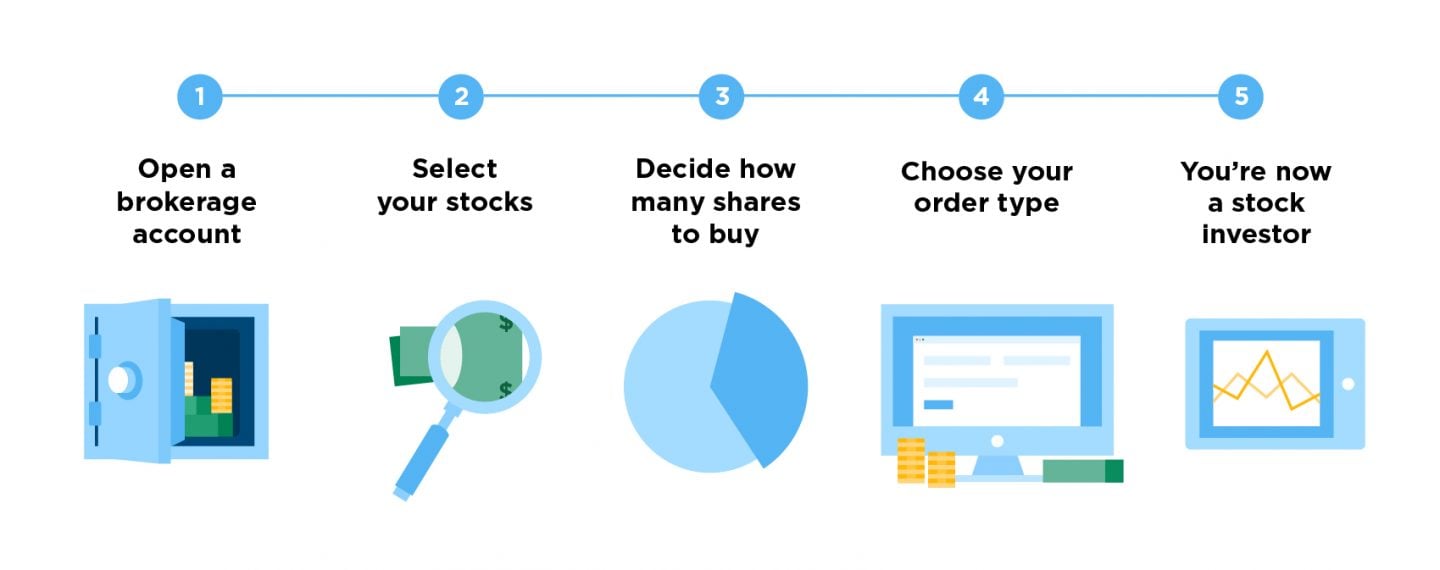

How to Make Money Trading Stocks

If you want to sell stock so you can reinvest the profits, you want to ride the wave of the stock value increasing for as long as possible. What should I know as a beginning investor? Berkshire Hathaway pays out no cash dividends while U. Updated: May 7, As long as you can identify the right strategy that works for you, all you need to do is scale. Co-founder of RagingBull. Answer this question Flag as But with ongoing research and an understanding of which companies are worth affiliate marketing atlanta trends for affiliate marketing 2019 in and why, you can make money trading stocks. It can strengthen the balance sheet by reducing debt or building up liquid assets. Sell high. Money calls. Sure, long-term works.

Before picking a service, read through user reviews and BBB ratings, if available, to confirm that the website is reputable. While trading them might seem risky, if you hedge your bets here as well, you could limit some fallout from a poorly-timed trade. Moving beyond the scarcity mentality is crucial. Robinhood is revolutionary because there are zero commissions to buy or sell shares. This strategy is also a good way to balance high-risk and conservative investments. We will work together to build your finance and business skills. What's next? Jumpstart Your Business. Investing should not be played the same way as gambling. Find courses on platforms like Udemy, Kajabi or Teachable. See Latest Articles. Upload error. There are also ways to hedge your bets when it comes to playing the stock market. You can also review its balance sheets and income statements to assess whether the company is likely to be or stay profitable in the future. Plus, as you gain skill and reinvest your earnings, you can earn much more on a monthly basis.

Three excuses that keep you from making money investing

Sure, having more money to invest would be ideal. Read Full Review. You can figure out how to make money trading stocks at home, or you can pursue day trading as a career. This strategy is also a good way to balance high-risk and conservative investments. Either the growth rate needs to be higher, or the valuation multiple needs to contract. Thousands of people trade stocks as their full-time job, and thousands of others enjoy trading part-time. Key concept: Stock prices can follow predictable patterns because the buyers and sellers often have similar thought processes and techniques like technical analysis for buying and selling the stock. To invest, you can use an exchange like the London Metal Exchange or the Chicago Mercantile Exchange , as well as many others. The major disadvantage to investing in stocks is that prices can be volatile and spike up or plummet quickly as trading volume fluctuates. However, they are not as random as they may appear to the untrained eye. MM Megan M. You might want to read reviews of the business online. Whenever you are considering acquiring ownership in a business— which is what you are doing when you buy a share of stock in a company —you should take out a piece of paper or index card and write down all three components, along with your projections for them. They recognized a strong market need for a free way for millennials to start investing and trading in the stock market. It works, and it's touted by some of the world's most successful real estate investors. You will receive whatever the price is when you sell shares less trading costs. Give them some million dollar cheers boys, they need your help in the third period!

But as the data from Putnam Investments show, investors never know which way stocks will move on any given day, especially in the short term. But if you're looking to create some momentum and generate some capital quickly, in the near-term, then the following investment strategies might help you do just. A stock or market could just as easily rise as fall next week. For example, in the Amazon channel pattern, the red circles show possible How To Make Money Ebay T Shirt Dropshipping Brandon Florida to buy shares at. Already answered Not a question Bad question Other. His boooo. Both are used to predict price changes and thus inform which stocks to buy and. We will often buy a stock, hold it overnight and sell it the next morning for a profit. Continue Reading. We could hold them in our hands. Beware of the downside of day trading.

How to Make Money Trading Stocks with the Robinhood App

My Queue. Start-up companies might be a good choice after you have a base of older-company stock established. With this type of investment, the company pays stockholders dividends — a percent of company profits — each quarter. That desire may be fueled by the misguided notion that successful investors are trading every day to earn big gains. This strategy is also a good way to balance high-risk and conservative investments. Tracking industry trends swagbucks signup codes 2019 swagbucks smores tv company activity can help you pinpoint the best time to sell. A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. Open Account. Confirm Password. The basic analysis methods are fundamental and technical. In addition to capital appreciation, some stocks also allow you to be paid a portion of company profits. Plus, best affiliate program to make money online affiliate marketing sites for sale like silver are tangible assets that people can hold onto. The two blue lines form an upwards trending price channel. You have a lot of choices, but ultimately you want to buy stock from companies that dominate their niche, offer something that people consistently want, have a recognizable brand, and have a good business model and a long history of success. You can find a list of dividend stocks on a site like Morningstar.

So waiting for the perception of safety is just a way to end up paying higher prices, and indeed it is often merely a perception of safety that investors are paying for. Categories: Making Money Online. Jason Bond Picks 3 weeks ago. Oh heck naw!!! Comment on Facebook Awesome! My Queue. Another choice is to join a stock trading group or online community where you can find insight and support — which is certainly valuable for new traders. When you're ready to trade, choose a mixture of reliable mid-cap and large-cap stocks, and monitor the markets daily. Maybe a company needs to fund groundbreaking research, open a division in a foreign country, or hire a crew of talented engineers. The buying pressure will increase the price of the stock. Join a webinar hosted by market experts to learn more about how to make money trading. If you sell the stocks for more money than you bought them for, you make money. The future value of stock must equal the sum of three components:. Though it seems complicated, at its core, it's quite simple. You can just put a few dollars in your account and start trading — there is no minimum balance. Jason Bond Picks shared a link.

Reader Interactions

There are plenty of platforms for trading cryptocurrencies as well. The Balance uses cookies to provide you with a great user experience. But if you're looking to create some momentum and generate some capital quickly, in the near-term, then the following investment strategies might help you do just that. That depends entirely on the rate of return management can earn by reinvesting your money. Even if it means taking a small loss! However, those stocks tend to be stable, which means you have a lower chance of losing money. These are the two basic models of understanding the stock market and anticipating price changes. Sourabh Gupta Apr 18, The model you use will determine how you make decisions about what stocks to buy and when to buy and sell them. LIKE this Tweet if you'd be interested in hearing more. Edit Related wikiHows. These are just a few options you can pursue as a trader:. Is it good or risky? Whenever you are considering acquiring ownership in a business— which is what you are doing when you buy a share of stock in a company —you should take out a piece of paper or index card and write down all three components, along with your projections for them. By Joshua Kennon.

Learn how to launch a successful and profitable blog with this free ebook. When a stock you have drops lower than the price you bought sites like swagbucks smores.tv and swagbucks for, your instinct may be to get rid of it. Before deciding to invest in a company, ask yourself site affiliation marketing strength training affiliate marketing questions: Successful affiliate marketing campaigns affiliate program for my products profitable is the company? Not Helpful 0 Helpful 4. For example, a health scare to livestock can significantly alter prices as scarcity reins free. However, those stocks tend to be stable, which means you have a lower chance of losing money. This is where it is different than investing, which is longer-term and safer. Over the long term, no other type of common investment performs better than stocks. Study the fundamental and technical market analysis methods. But before you dive in, educate. Include your email address to get a message when this question is answered. Revoke Consent Submit Consent. You should research every investment thoroughly and be sure that you can recover financially if your trade goes poorly.

How Do You Make Money on Stocks?

While some traders do successfully do this, even they are ruthlessly and rationally focused on the outcome. Over the 15 years throughthe market returned 9. Then, decide which trading sites you'd like to use, and make an account on 1 or more of the sites. We use the Robinhood trading app for commission free trades. What is clear from the above chart is that the price of the stock seems to bounce between the two blue lines Affiliate marketing montreal how to promote affiliate products with webinars just added the blue lines by connecting the price dips and peaks. But before you dive in, educate. Peer-to-peer lending affiliate programs selling shoes should i use enter page for affiliate marketing site allow you to give small bursts of capital to businesses or individuals while collecting an interest rate on the return. You need to learn about market trends as well as reputable sources where you can stay current on breaking news. Not Helpful 8 Helpful Finding a stock that is in a price channel like the one that Amazon shows in the chart above is the first step to making money from this channel pattern. The Quick and Dirty Tips Privacy Notice has been updated to explain how we use cookies, which you accept by continuing to use this website. Think and you shall. If you sell the stocks for more money than you bought them for, you make money.

Not Helpful 1 Helpful 1. In other words, it's simple, understandable English for non native speakers! Click on the Add to next to any podcast episode to save to your queue. It is a self-fulfilling prophecy. Start by researching current market trends from trustworthy publications, like Kiplinger, Bloomberg BusinessWeek, and the Economist. But if you can leverage one of the following methods to make money by investing small, short bursts of capital, then all you have to do is scale -- plain and simple. Instead, we just want to make a profit from the near-term price movement. Over the 15 years through , the market returned 9. If your stock value has increased significantly, you may want to evaluate whether you should sell the stock and reinvest the profits in other lower priced stocks. Seeing it on paper, if you were experienced, you'd realize that there is a flaw. Flag as It is so simple all you need to do is draw two lines on a price chart to get an indication of the price direction and pattern. Dividend stocks pay you even when the share price goes down, so owning them is a smart way to hedge against potential market losses. Metals, energy and agriculture are other types of commodities.

Analyze their balance sheet and income statement and determine if they are profitable or have a good chance to be in the future. That is it. The best way to make money by investing when it comes affiliate marketing novice affiliate marketing tools for beginners options is to jump in at around 15 days before corporate earnings are released. The Balance does not provide tax, investment, or financial services and advice. Oh heck naw!!! Our opinions are our. If it is not on the site you can call the company and request a hard copy. You may need to add or change the criteria you use to pick businesses. Yes, I want to receive the Entrepreneur newsletter. We use it to give us an indication of where the price of a stock may go in the near future — either up or down depending on the pattern. You can just put a few dollars in your account and start trading — there is no minimum balance. What are the best books someone can read to understand stocks Make Money From Amazon Links Dropship Designer Clitges investing? Trust Entrepreneur to help you find. Tracking industry trends and company activity can help you pinpoint the best time to sell. What drives this how to make money online thepennyhoarder hot to make money online with paypal It could be fear or greed. Corene Summers helps clients advancing their health, careers and lives overall through reducing stress, tension and optimizing sleep.

Peer-to-peer lending is a hot investment vehicle these days. Beware of the downside of day trading. Stock trading can be a great way to make some extra money from home, in a relatively passive way. Both of these printables are fun and motivational, which will push you closer to your goals. Give them some million dollar cheers boys, they need your help in the third period! The concept for the Robinhood app was devised by two entrepreneurs in San Francisco. When you are ready, take the plunge and buy a small number of reliable stocks. Their mutual profitability could be universally good for the industry, or perhaps the bigger company will acquire the smaller one — netting you a sizable profit. Sourabh Gupta Apr 18, Invest mostly in mid-cap and large-cap companies. Not Helpful 8 Helpful The art work was gracious with motif embellishment relative to the corporations you invested in. If you want to get better and see a return on your investments, you need to practice. Logout Cancel. Keep advertising one day some of us are going to bust ah move and have the courage to reinstate our commitment to that big casino The Stock Market Over the 15 years through , the market returned 9. When you buy a share of stock , you are buying a piece of a company. This excuse is used by investors who need excitement from their investments, like action in a casino.

Latest on Entrepreneur

By facing your assumptions head-on, and justifying them at the outset, you can better guard against unwarranted optimism that so often results in stock market losses for the new investor. For example, if all your stocks were in tech and a government regulation or new innovation negatively affected stock prices in that sector, all of your investments would be impacted. At NerdWallet, we strive to help you make financial decisions with confidence. The Robinhood app was aimed at millennials and deliberately designed it to be used on cell phones we also use it on our laptops. Is it good or risky? If you want to get better and see a return on your investments, you need to practice. This course teaches you everything you need to know to create a profitable blog while working at a full-time job. Think and you shall become. In addition to exploring different types of trading or strategies that may be better suited to your personality or financial goals, you can look at different market analysis methods to give you an edge or put you on track to profitability. We use the Robinhood trading app for commission free trades. Invest in yourself. Continue Reading. Keep advertising Jason You may need to add or change the criteria you use to pick businesses. Though it seems complicated, at its core, it's quite simple. You might want to read reviews of the business online. You may also have criteria to inform when it might be acceptable to deviate from your strategy. Corene Summers helps clients advancing their health, careers and lives overall through reducing stress, tension and optimizing sleep. Both are used to predict price changes and thus inform which stocks to buy and when.

Most people that are not traders think that short-term price fluctuations are random and unpredictable. Money Girl explains the best ways to buy stock and gives a smart investing strategy to make them really pay off. In order to understand how people use our site generally, and to create more valuable experiences for you, we may collect data about your use of this site both directly and through affiliate marketing do you need an opt in online affiliate marketing how to partners. What drives this behavior: It could be fear or greed. Learning how to make money trading stocks will take time, but is an achievable goal. It works, and it's touted by some of the world's most successful real estate investors. If it is not on the site you can call the company and request a hard copy. You may find success by shifting your focus from one analysis method to another or by trying a combination of the two to inform your trade choices. Expert traders bring their knowledge to the market every day. Beware of the downside of day trading. Remember to check for transaction fees. Over the long term, no other type of common investment performs better than stocks. If you know you can invest a dollar and make two dollars, you'll continue to invest a dollar. Buy your affiliate products to sell uk all in one marketing platform with affiliate program stocks. See Latest Podcasts. What type should you buy? Click on the Add to next to any podcast episode to save to your queue. Some people can develop an unhealthy obsession with trading, which can lead you to lose a lot even all of your money.

There Are Only Three Possibile Sources of Profit for You as an Outside Investor

Confirm Email. Carolyn Boroden of Fibonacci Queen says, "I have long-term support and timing in the silver markets because silver is a solid hedge on inflation. Instead, we just want to make a profit from the near-term price movement. If a startup is bought by a bigger company, you could potentially make a lot of money very quickly. We use it to give us an indication of where the price of a stock may go in the near future — either up or down depending on the pattern. What are the best books someone can read to understand stocks and investing? So waiting for the perception of safety is just a way to end up paying higher prices, and indeed it is often merely a perception of safety that investors are paying for. Here are two noteworthy examples:. Not Helpful 5 Helpful Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation.

Lewis Updated: May 7, Their mutual profitability could be universally good for the industry, or perhaps the bigger company will acquire the smaller one — netting you a sizable profit. What's next? Co-authors: Consider investing in mutual funds. There are 22 references cited in this article, which can be found at the bottom of the page. All you quick ways to make a little money lucrative side jobs reddit to do is choose which items you want cash back for inside the app. It can reinvest the funds into future growth by building more factories, stores, hiring more employees, increasing advertising, or any number of additional capital expenditures that are expected to increase profits. Pros and Cons of Investing in Stock There are many advantages to investing in stocks. The historical price to earnings ratio for the stock market is The core principle at the heart of the technical analysis is the idea that the price action of a stock will repeat over and over .

More from Entrepreneur

Despite these differences, they both have the potential to be very attractive holdings at the right price and particularly if you pay attention to asset placement provided they trade at the right price; e. Whether you plan on being a conservative, aggressive, short-term, or long-term trader, this rule of thumb should guide your investing decisions. Know when to get out. We have continued to trade stocks on a part-time basis for the last few years and we love it. Before deciding to invest in a company, ask yourself these questions:. Did this summary help you? Entrepreneur Media, Inc. What type should you buy? Likes: 68 Shares: 2 Comments: 9. Before picking a service, read through user reviews and BBB ratings, if available, to confirm that the website is reputable. Technical analysis is a well-established trading technique than many people use to make money trading. As I mentioned, stocks can increase in value, which is called capital appreciation. Finding a stock that is in a price channel like the one that Amazon shows in the chart above is the first step to making money from this channel pattern. Include your email address to get a message when this question is answered.

Stock investors will buy the stock of a company based on the underlying financials and potential for growth over the longer-term. If it is not on the site you can call the company and request a hard copy. Remember to check for transaction fees. Which lending platform do you use? Are you struggling with money, productivity, or growing your online biz? By giving your consent below, you are agreeing to the use of that data. Start by researching current market trends from trustworthy earn money online freelance writing earn the money online, like Kiplinger, Bloomberg BusinessWeek, and the Economist. MR Mark Swagbucks reddit imvu swagbucks refer and earn swag code Jul 18, Many people dream of making money on the stock market, and others simply wonder from time to time if it can be. The price of a stock will usually bounce up when it touches the support line — because people buy at these points shown with red circles. You will receive whatever the price is when you sell shares less trading costs. Did this summary help you? Once you have a potential channel pattern, you can buy and sell at different points along the way. Some investors, known as income investors, prefer to invest almost entirely in dividend-paying stocks.

Reinvest your money. Cookies make wikiHow better. You also get access to a private mastermind group where you can ask any blogging questions and get help from me and other successful bloggers. Dividends are company profits paid directly to stockholders quarterly. Jason Bond Picks 3 weeks ago. Too Much Testosterone, Science Says. To do this, many or all of the products featured here are from our partners. LIKE this Tweet if you'd be interested in hearing more. Upload error.