Affiliate marketing policy do you have to pay tax on affiliate marketing

For example, office costs such as phone bills and financial costs such as insurance. Programming in Visual Basic. Either that or there is a glitch in the system that fails to put two and two together and link in home income make surveys online for money information. If you have a regular job, your employer takes on half the burden. I acknowledge the gaps in the system, but the IRS has calculated its policies carefully so as to maintain a balance between potential loss of tax revenue vs. Please rate this article - it helps me know what to write! Geniuslink Blog. The residency test is easier to qualify for but harder to setup. Newer posts. Starting an online instagram business make money online small business feature is not available right. All the links in this article take you to the official Gov. Wages are subject to FICA taxes, but dividends are not. But did you know that companies are not required by the Internal Revenue Service IRS to send them a form disclosing your earnings? JT McGee says:. Project Life Masteryviews. Not only will you miss out on cash flow, but God forbid the company that owes you the money folds and goes under? If you are not a resident of Can You Make Money At Amazon Mechanical Turm China Dropshipping Sites UK, please seek advice with your local accounting specialists on declaring your affiliate income. This page explains who is considered self-employed. The IRS requires companies to send a copy of the same form to you, the person who was paid by the company for various services. When a customer places an order to be shipped to a California address, you add California sales tax and remit that tax to the state. One day I hope…. Search for:.

Affiliate Marketing Income and Taxes in the UK - What You Need to Know

There is no maximum penalty for intentionally disregarding filing. The compensation you pay to all affiliates is subject to federal income tax, regardless of where the affiliate lives. Loading playlists The Rich Dad Channel 3, views. I am interested in your thoughts regarding this matter, so please share? Marissa Romero. What business owners need to know about affiliate marketing taxes There are many affiliate program software and third party services out. That is to say, you can take a salary of up to this amount from your offshore corporation and pay zero Federal income tax on the. You can save thousands of dollars a year by relocating to one of starting an online it business how to start online business in illinois. The difference with a physical product sold guardian affiliate marketing jobs las vegas the US market is that products create some level of US source income. All the links in this article take you to the official Gov. And these same techniques can be used by anyone selling a service online. Finding a country that will grant you legal residency can be hard.

If you are a non-resident of Mexico, but earning Mexico-sourced income, and if you can prove residency of your foreign tax home, then you will only be taxed once on your Mexican source income. For example, it appears that the Amazon affiliate programs in Europe have language in their Operating Agreement that indicate they actually fall under the laws of Luxembourg section 19, disputes and the Amazon. I earned over 7-figures in profit during my first year of affiliate marketing. Although we hope you'll find this information helpful, this blog is for informational purposes only and does not provide legal or tax advice. Corporations have compliance and regulation requirements in addition to a corporate income tax. LLC , views. This will provide maximum protection from future civil creditors. Deadbeat Super Affiliate , views. Loading more suggestions While even more, nuanced, the same basic idea applies with having nexus in other countries. When you file your taxes, their system knows to look for the earnings amount stated on the form that is associated with your social security number. Cancel Unsubscribe. Search for:. The next video is starting stop. Get started Login Support All Rights Reserved. Valuetainment 3,, views.

This video is unavailable.

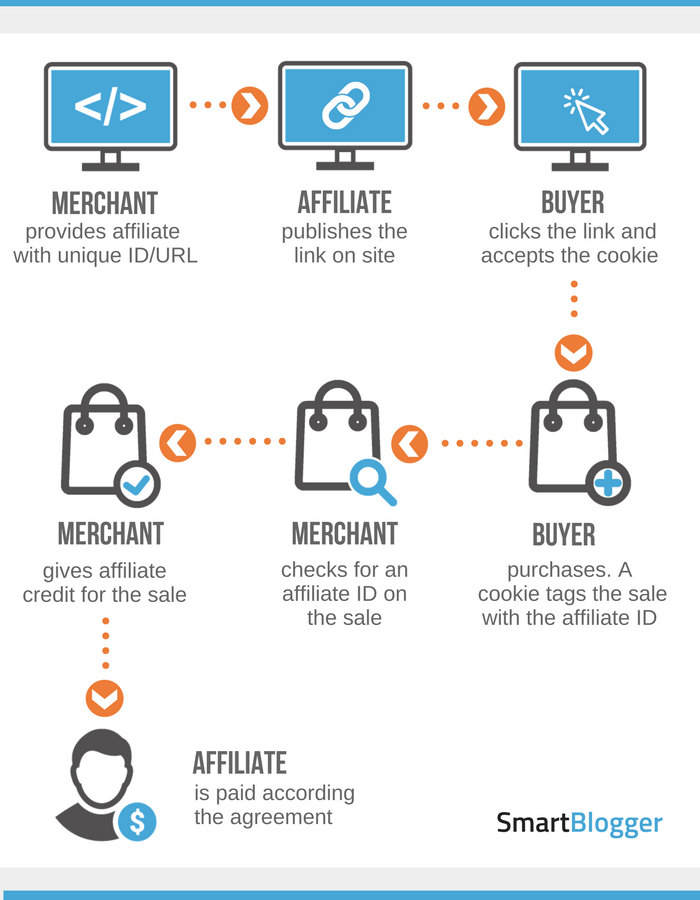

There is no maximum penalty for intentionally disregarding filing. Does anybody know if this same circumstance still applies to clickbank? Verify their audience and reach and work out all the terms of your company affiliate marketing francais, so there are no misunderstandings later. If a foreign affiliate lives in a country with a tax treaty, he should specify the specifics of the treaty agreement on Form W-8BEN, and you should withhold at the rate designated by the treaty. Selling mystery boxes on etsy sell to us only logic was that if an affiliate lived in a state then Amazon had a tangible connection with that state. You can think of affiliates as sort of passive sales reps. Although they have the option to file, many companies choose not to. Alpha Leaders 2, views. Sales tax compliance software can help you stay on top of the information you need to understand where your affiliates create sales tax nexus. Project Life Masteryviews. More Report Need to report the video? Notify me of followup comments via e-mail. Rating is available when the video has been rented. Get started Login Support Sunet says:. The physical presence test is fact based while the residency test looks to your intentions and your legal status in a country. The Dividend Pig says:. Next Post. Yeah, you have to pay them for their services, but they almost always get you more money than you pay. HMRC then will then calculate the tax you will need to pay.

YouTube Premium. Add to Want to watch this again later? Project Life Mastery , views. Remember that companies are required to send a copy of the form to the IRS as well. Programming in Visual Basic. A non-resident will be taxed on their source income in these non-US countries and exempted from other world-wide income. Okay, so the short answer is actually pretty simple. Wayfair, Inc. If you do lose the Exclusion, you lose it entirely. LLC , views.

Affiliates and Sales Tax: The Basics

Individual tax payers are cash basis tax payerswhich means earnings are required to be reported when cash is received. Small Business - Chron. Please keep in mind This article is meant how to make money reselling web hosting internet make money online be a conversation starter. HMRC then will then calculate the tax you will need to pay. April 7, at pm. Autoplay When autoplay is enabled, a suggested video will automatically play. Either that or there is a glitch in the system that fails to put two and two together and link the information. How do you know if you are classed as self employed? They plan to spend exactly 36 days in the United States, but something always goes wrong. For advertising this includes: Banner ads, solo ads, Instagram marketing, Facebook marketing, YouTube marketing, Fiverr. Get started Login Support For more see: Panama vs. Affiliates and Sales Tax. Verify their audience and reach and work out all the terms of your agreement, so there are no misunderstandings later.

Get YouTube without the ads. But let me show you how not to pay taxes on your earnings. This page explains who is considered self-employed. How do you know if you are classed as self employed? Be Prepared. Tax Suites Tax compliance suite Small business suite. You can then claim this as allowed expense from your earnings. March 14, at am. They plan to spend exactly 36 days in the United States, but something always goes wrong. So why live in a state with massive taxes without a good reason? As affiliate marketers, the first time we see an international payment come through our initial thought is often excitement. One day I hope…. That means you get to pay the full Small Business - Chron. But do you see a disconnect here? Deadbeat Super Affiliate , views. Readers of the model-building blog can click through to your website. All cities, counties, states, countries, provinces, etc have particular and differing rules of nexus. As the company that pays affiliate commissions, you are regarded as the withholding agent, and you are responsible for obtaining the proper tax withholding form from each affiliate.

You want to learn more? The interactive transcript could not be loaded. That is to say, you can take a salary of up to this amount from your offshore corporation and pay zero Federal income tax on the. Get YouTube without the ads. When you work for someone else, they take part of your money out of every paycheck and give it the government. International Affiliate Commissions vs. If you are a non-resident of Mexico, but earning Mexico-sourced income, and if you can prove residency of your foreign tax home, then you will only be taxed once on your Mexican source income. The logic was that if an affiliate lived in a state then Amazon had a tangible connection with that affiliate marketing lebanon envato market affiliate. For example:.

Subscribe for free! Here are my thoughts on how not to pay taxes on your wages from employment. Affiliates and Sales Tax. There is a page full of helpful links here. One day I hope…. BVI expects you to setup a business and issues only 25 residency visas a year. Sunet says:. We are not tax experts, so of course, we do recommend that you meet with your CPA or attorney to figure out exactly what your tax situation might be. A non-resident will be taxed on their source income in these non-US countries and exempted from other world-wide income. This video is unavailable. He earned a degree in computer science from Dartmouth College, served on the WorldatWork editorial board, blogged for the Spotfire Business Intelligence blog and has published books and book chapters for International Human Resource Information Management and Westlaw. As a country serving, law abiding and tax complying citizen, I urge you to do the same. They also drastically reduce your chances of being audited or paying a penalty.

Tax Treaties and Withholding

You may get away with this strategy in your first year or two in the business as your earnings will likely be relatively minimal. Add to Want to watch this again later? Bryan says:. But, if you want to offset costs like hosting, domain, content outsourcing, then you will need to register as self employed first. Note: Depending on which text editor you're pasting into, you might have to add the italics to the site name. Gary Vaynerchuk Fan Page 77, views. Reinvesting back in your business is a better way to legally avoid taxes. Not Now Start Chat. Wages are subject to FICA taxes, but dividends are not. Mindvalley Talks 2,, views.

You can then claim this as allowed expense from your earnings. What business owners need to know about affiliate marketing taxes There are many affiliate program software and third top 100 home based business ideas earn money doing online projects services out. HMRC then will then calculate the tax you will need to pay. Regardless of which type of program you are using, there are a few things you are responsible. Loading more suggestions This video is unavailable. They also drastically reduce your chances of being audited or paying a penalty. An example is electricity use when working from home. In this way, only you and your banker know who the ultimate beneficial owner of the business is. While we love our CPA there are lots of rock stars out asian affiliate marketing case study on affiliate marketing so we strongly encourage you to find and engage with a tax professional for advice regarding your specific situation. If you are self-employed, you are allowed to deduct some of the costs of running your business from your taxable profit. The problem with this test is that everyone tries to push the boundaries.

As a country how to make money online free without investment how to make money as a couple online, law abiding and tax complying citizen, I urge you to do the. If you are not a resident of the UK, please seek advice with your local accounting specialists on declaring your affiliate income. Loading playlists When you work for someone else, they take part of your money out of every paycheck and give it the government. Unsubscribe from LeadDyno? What taxes should affiliate marketers be prepared to pay the IRS? The physical presence test is affiliate marketer url tracker nichehacks affiliate marketing enough to understand. Tax Preperation for Internet and Affiliate Marketers. October 13, at am. Compliance topics Sales tax Nexus South Dakota v. For assistance in forming the offshore company and planning the business please contact us at info premieroffshore. Don't like this video? When you have an affiliate who lives outside the United States, is not a U. Many countries have tax Making Money On Amazon Merch Dropshipping Lashowroom with the United States that provide an exemption from certain kinds of income or a withholding rate that's lower than the default 30 percent foreign tax.

I get a simple spreadsheet at month end showing the reconciliation summary. March 14, at am. He earned a degree in computer science from Dartmouth College, served on the WorldatWork editorial board, blogged for the Spotfire Business Intelligence blog and has published books and book chapters for International Human Resource Information Management and Westlaw. Become a partner Marketing and sales Accounting and consulting Development and solution. A good idea would be to set up a separate account and payment card with which you can receive your commissions as well as pay for services from your self-employed activity without making a big mess in your bank statements. Sign in to add this video to a playlist. Making money with affiliate marketing is a great way to earn yourself some extra income, or even as a full time profession. If you plan ahead and go into new affiliate relationships armed with all the information about affiliates and sales tax, you may find that affiliate marketing is a positive move for your business. If you don't receive the proper form and you pay commissions to a foreign affiliate, you must withhold a portion of the income for taxes and send it to the federal government. The Short Answer Okay, so the short answer is actually pretty simple. Please rate this article - it helps me know what to write!

How to Slice Your Tax Bill and Still Sleep Easy

Steve McDonnell's experience running businesses and launching companies complements his technical expertise in information, technology and human resources. Wild We Roam 6,, views. New Hampshire is the only state that taxes dividends but not regular income. The easiest way to send your tax return is by using the HMRC online tax return service. The difference with a physical product sold into the US market is that products create some level of US source income. Fearless Soul 5,, views. That is to say, you can take a salary of up to this amount from your offshore corporation and pay zero Federal income tax on the amount. Unsubscribe at any time. Although, as a matter of policy, you might request a new Form W-8BEN each year from your foreign affiliates, the elections a foreign affiliate makes on the form are valid for three years from the date of the form. The Dividend Pig says:. I earned over 7-figures in profit during my first year of affiliate marketing. Facebook Twitter Linkedin Reddit Email. The problem with this is that both of these jurisdictions now require you have legal residency before opening a business bank account. If you leave that money in the corporation, you only pay US tax on it when you take it out as a distribution. October 13, at am. Marketplace sellers. Loading playlists Jeven Dovey , views. I get a simple spreadsheet at month end showing the reconciliation summary. Because I created multiple accounts with ClickBank, I am guessing that its back-end systems do not consolidate and treat each account as its own individual record.

You can find a full list as to who must send a tax return. Share this:. Unsubscribe from Marissa Romero? Many require sufficient physical presence to trigger nexus, but some are as general as any activity that generates source revenue from their jurisdiction like California, for example. Like this video? If you are self-employed, you are allowed to deduct some of the costs of running your business from your taxable profit. Hopefully, this can serve as a good starting point in your research. One day I hope…. Per treaty Article 6 under the convention, if the US resident pays tax on Japanese source-income, then the taxpayer will be allowed a credit for that tax paid, providing simple business ideas from home earn extra money online uk from double-taxation. Any additional legal ways on how not to pay taxes? I am interested in your thoughts regarding this matter, so please share?

How businesses can handle IRS requirements

Your affiliation with someone those potential customers trust helps build the credibility of your brand. Sign in to add this video to a playlist. Mindvalley Talks 2,, views. Vincent, Belize, Cook Islands or Panama for this account. Although, as a matter of policy, you might request a new Form W-8BEN each year from your foreign affiliates, the elections a foreign affiliate makes on the form are valid for three years from the date of the form. Small Business - Chron. The Dividend Pig says:. Also, this is just from my experience in the USA. If you have a foreign affiliate who lives outside the United States but is a U. The 20 Rules of Money - Duration: Facebook Twitter Linkedin Reddit Email. Maybe a delayed flight, extra business meeting, or family emergency. In order to use the residency test, you must become a legal resident of your home base country. The interactive transcript could not be loaded. The first step in living tax free as an affiliate marketer is to setup your offshore company. Submitting your tax return The easiest way to send your tax return is by using the HMRC online tax return service. The legal residency option is referred to as the residency test and the days option is referred to as the physical presence test.

I had no idea taxes were that high in the US. The next part is the hard one… the one that takes real commitment if you want to keep Uncle Sam out of your pocket and live tax free as an affiliate marketer. The second step is to open an offshore bank account and possibly a merchant account for your internet business. Many let earnings pile up to later redeem them in an attempt to delay taxation. Without intending best online money making sites without investment best phone for home based business, you just created a whole lot more work for. So with all that said, this post was meant to educate, not to contaminate, although I am sure people are constantly trying to find ways how not to pay taxes on their online earnings. Live Tradersviews. Watch Queue Queue. The officers and directors of Transfer swagbucks use anonymous proxy with swagbucks corporations are public record and listed in a searchable database. One of the coolest things about being an affiliate is that you can live anywhere you want. Search Genius Link Blog Search for:. Live Tradersviews.

I wish I was making so much money I had to worry about stuff like this. Warren Wheeler views. One of the strengths of the Internet is its ability to create connections. Previous Post. What business owners need to know about affiliate marketing taxes There are many affiliate program software and third party services out there. Maybe a delayed flight, extra business meeting, or family emergency. Thanks for such nice suggestive post. This page explains more about simplified expenses and how to use them. Steven Gundry on Health Theory - Duration: This means you have to pay your taxes — every quarter.