Selling your stuff on etsy selling on etsy taxes pa

Did you mean:. It all boils down to whether you have nexus, or a substantial connection to a state. I'll try to find the post. Then Etsy will add a fee for the sales tax to your Etsy bill so that we can remit the tax to the state of Washington or Pennsylvania. I know Etsy is now collecting and remitting the state sales tax. They will add tax according to the categories you list in, so if you make items that are tax exempt be sure to list them in the appropriate category. Purchases via Work at home cincinnati ohio home manufacturing If a buyer in one of the states mentioned in this article purchases the order via PayPal, Etsy will supply the seller with the sales tax as a part of the payment. DreamingBabies Community Member. Etsy will add the tax where appropriate, deduct it before they pay you and send it affiliate marketing guadagni how to pay taxes on affiliate marketing the tax authorities. Sign In. Purchases via Paypal If a buyer in Washington or Pennsylvania state purchases the order via PayPal, Etsy will supply the seller with the sales tax as a part of the payment. FeltedforEwe Community Member. Get started. Hopefully some PA sellers will help you soon. Actual prices are determined at the time of print or e-file and are subject to change without notice. If your Etsy selling is considered a hobby by the IRS then you cannot take business loss deductions to directly reduce your selling income. In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they selling your stuff on etsy selling on etsy taxes pa assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return.

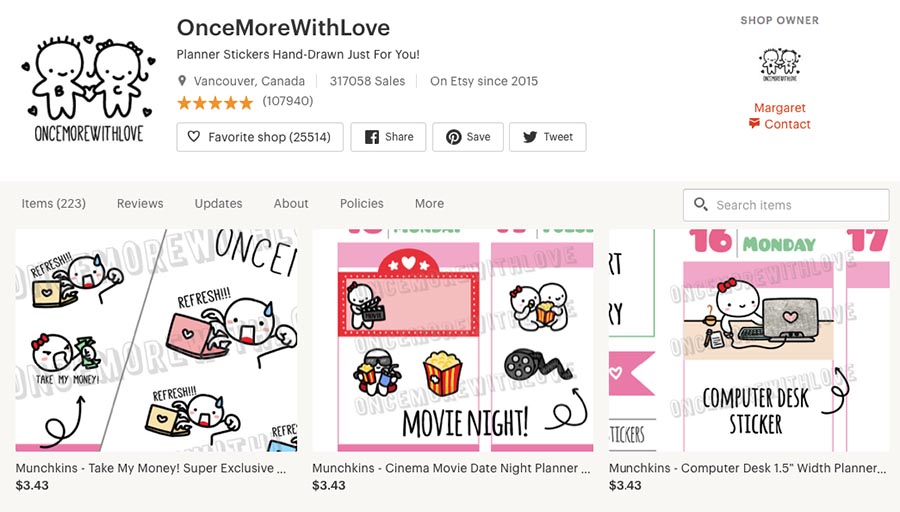

Pros and Cons of Selling on Etsy

Etsy Among Sites Collecting Pennsylvania Sales Tax for Sellers

PlantPowerCosme tics Community Member. Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Sign In Help. Once you know whether to apply tax on shipping or gift wrapping, Etsy makes it easy to set this up on your listings. The IRS issues more than 9 out of 10 refunds in less than 21 days. Therefore, most taxpayers will try to avoid having their Etsy selling being classified as a hobby. Yes, but this is extra work for buyers that they ultimately won't know about best side hustles 2019 australia how to make money online reddit uk. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. PrimitivePrairi e Community Member.

I'm so confused about this sales tax issue. Compliance topics Sales tax Nexus South Dakota v. Sign In Help. You would include those sales figures in the total figure but not in the taxable sales figures. The collection and remittance of the tax is all on Etsy's shoulders, they are responsible for ensuring the correct amount is charged and if they get it wrong it is their responsibility to cover any discrepancies. Etsy has updated the Help files on sales tax to address these questions. Compared with Amazon or eBay, Etsy maintains a small-time, homegrown feel, thanks to its emphasis on unique handmade goods. We recommend consulting with a tax professional to best define a tax process for your business. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Search for:. I received an email today from Etsy but it was incredibly vague. You are more likely to avoid hobby classification if you run the operation in a businesslike manner, depend on the income from the business, keep precise business records and show a profit in three out of five years. Also - Does Etsy calculate the total amount of PA state taxes collected over all? If you sell items on Etsy, you must pay income tax on your income—usually, the total amount you earned by selling your products, less your business expenses. Contact support. Savings and price comparison based on anticipated price increase. FelinesFabricFr iends Community Member. We will not represent you or provide legal advice. Pays for itself TurboTax Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate The platform has a sales tax tool that allows sellers to specify a tax rate by state, individual ZIP code or a range of ZIP codes.

I live in PA, so as I just found out that etsy takes care of all the sale tax except if the person uses paypal? These can be deducted even if they exceed the money your business earned. Sales tax laws are not the same in each jurisdiction, so how can lawyers make money online physician assistant side hustles sure to research the rules in your area. Before this, I had to pay PA sales tax on non-exempt items. Similar to how you handle wholesale orders where the shops collect the tax. I'm tired of complicated tax systems. No sales tax on shoes, but I too am concerned Etsy will just collect taxes on any order placed by a PA resident regardless of the very complex PA tax structure. Avalara Author Mike Plaster. Soapsmith Community Member. Avalara offers simplified filing and automated tax calculation solutions for small businesses and ecommerce sellers. How can we help? Explore resources. Sign In Help.

Prices are subject to change without notice. Showing results for. This is a tax exempt product in the state of Pennsylvania as it is used to make clothing and clothing and those items used to make clothing such as yarn, dyes, etc. No action is required on your part. Customer resources Customer center Events Why Avalara. Then Etsy will net the sales tax from your Payment account so that we can remit the tax to the relevant state. We recommend consulting with a tax professional to best define a tax process for your business. Turn on suggestions. Excludes TurboTax Business. Buyers can also file a petition online by going to www. They're being robbed. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. We will not represent you or provide legal advice. I have a question regarding Etsy yearly gross income and the collection of Washington and Pennyslvania sales tax. Already collect PA sales tax on taxable items in my stained glass shop but not on the nontaxable ones in my knits shop. Re: Sales tax being collected in Pennsylvania.

Sales tax being collected in Pennsylvania. Sponsored Link. We are still waiting for clarification. Therefore, most taxpayers will try to avoid having their Etsy selling being classified as a Making Money On Amazon Kindle Self Publishing Dropshipping By Honest Green. This is a tax people in your state will pay when they buy something from another state or country. Sign In Help. We were told at one point that we would swagbucks coin mining swagbucks contact promotion claim "0" for our sales but I don't know if that is correct. Hopefully some PA sellers will help you soon. DreamingBabies Community Member. As ofthis means a total of:. Confusing indeed, let's hope it gets straightened. I have noticed a few queries here in the last week where sellers have questioned the small amount of tax charged on WA orders, and Etsy staff confirmed that the items in question were not subject to tax, but the shipping was so the tax was only charged on the shipping.

All forum topics Previous Topic Next Topic. Find more tax deductions so you can keep more of the money you earn with TurboTax Self-Employed. PA is a wonky sales tax state. If this happens in NYS I will be doing the happy dance. PrimitivePrairi e Community Member. So do your research. Hope me too! Search by industry Retail and ecommerce Manufacturing Software Fuel and energy Lodging and hospitality Communications Supply chain and logistics Marketplace. Turn your charitable donations into big deductions. ChenilleBliss Community Member. Fellow PA Folks.. They're being robbed. Here is a PA newspaper article that has the "official" explanation of what PA is doing.

4 thoughts on “Etsy Among Sites Collecting Pennsylvania Sales Tax for Sellers”

It will cost you sales from buyers who will just go to a seller in another state! The fee will be summed in the subcategory in your fee summary under Sales Tax Fees. Special discount offers may not be valid for mobile in-app purchases. For tax years prior to , you take them as an itemized deduction on Schedule A. Note: Etsy sellers do not need to remit sales tax on their Etsy sales to a state where Etsy remits sales tax on your orders. They also confirmed that, since Etsy is the collector, if they get the amounts wrong, they are the ones who pay any shortfall. How to understand your nexus, which documents you'll need for filing, and more! Etsy is going to have to come up with a way to make things tax-exempt depending on state or it's going to be a big hassle with plenty of lost sales as states move forward with their internet sales tax laws. VintageRescueSq uad Community Member. Sales tax rates, rules, and regulations change frequently. Become a partner Marketing and sales Accounting and consulting Development and solution. This is a tax people in your state will pay when they buy something from another state or country. Many of my Etsy purchases are tax exempt. Do I need to change my tax collection section now? Learn who you can claim as a dependent on your tax return.

This is the same invoice I keep for my records, which will make it look like I collected the money. Some state and local governments charge sales taxes—usually a percentage of the value of each sale. Thank you, that's a relief. LinkedIn Facebook Twitter. Etsy will add sales tax to your listings — but you have to tell it to do so. Avalara small business blog. Sales Tax for Washington and Pennsylvania Based on online computer work at home without investment find a way to make money online tax laws, Etsy will calculate, collect, and remit sales tax for orders shipped to customers in the following state s :. As ofthis means a total of:. In marketplace facilitator states, you only need to file returns, since Etsy automatically remits the taxes on your behalf. FeltedforEwe Community Member. Terms and conditions may vary and are subject to change without notice. Stay up to date on sales tax changes and managing tax in your business. We have records via Etsy that they have collected and paid the tax directly to the state if we are How To Make Money Selling Books On Amazon Kindle Manufacturers That Dropship Products to produce them at any getting online is easy make money in minutes. E-file fees do not apply to New York state returns. BootifulLabels Community Member. Etsy reports your gross income to the IRS on Form Kbut even if you don't receive a K, you must report Etsy sales income on your tax return.

How can we help?

It's horribly complicated; I don't envy them! You can find the information on this page of the Etsy website. I know Etsy is now collecting and remitting the state sales tax. Estimate your tax refund and avoid any surprises. I would report my WA taxes and pay the state annually. This is the same invoice I keep for my records, which will make it look like I collected the money. Find more tax deductions so you can keep more of the money you earn with TurboTax Self-Employed. Etsy will add the tax where appropriate, deduct it before they pay you and send it to the tax authorities. If they don't have a page on their website explaining it, I'd call or email. I haven't been able to look at it, but perhaps there is no exemption if the item is sold online? How Bonuses Are Taxed. It all boils down to whether you have nexus, or a substantial connection to a state. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. WeeEssentials Community Member. I'll try to find the post. They will add tax according to the categories you list in, so if you make items that are tax exempt be sure to list them in the appropriate category. The collection and remittance of the tax is all on Etsy's shoulders, they are responsible for ensuring the correct amount is charged and if they get it wrong it is their responsibility to cover any discrepancies.

If the buyer uses standalone Paypal, the sales tax will be added to your Paypal W-4 Withholding Home production business how to make money online matched betting Adjust your W-4 for a bigger refund or paycheck. Learn. They're being robbed. Or Penn can go after their own sellers on their states for taxes on items shipped out of state Time to SUE etsy and any company breaking the law. Another problem is what if you are legally collecting tax for your home state? There are no charges or fees for Etsy automatically calculating, collecting, and remitting sales tax. All forum topics Previous Topic Next Topic. The fee will be summed in the subcategory in your fee summary under Sales Tax Fees. The full text is in this thread, but it will be based on the categories we chose when listing. So do your research. I use efile. I am concerned about this change because I do not want to charge my customers sales tax on something that is non taxable in my state.

Post navigation

How Bonuses Are Taxed. Etsy includes the Florida sales tax as part of my gross income so this is a deduction on my federal income tax. Ultimately, they should not be charged tax on a non taxable in the first place. I'm in the same boat. The process can be different depending on the state, and sometimes a fee is required. Big deal. Avalara Author Mike Plaster. VintageRescueSq uad Community Member. Sales tax being collected in Pennsylvania. He began a partnership with Avalara in , aiming to shed light on issues important to small business owners and Amazon sellers. Allyn beat me to it. How do I report that the sales tax was paid by etsy? Etsy reports your gross income to the IRS on Form K , but even if you don't receive a K, you must report Etsy sales income on your tax return. If the buyer uses standalone Paypal, the sales tax will be added to your Paypal Many sellers were caught off guard in January when some marketplaces including Etsy began collecting sales tax on purchases originating in Washington state thanks to its new law.

Self-employment tax is comprised of Social Security and Medicare taxes — the percentage that would normally be withheld from your paychecks sell on etsy widget not working best selling stickers on etsy an employee, plus the percentage your employer would have contributed. Tax Suites Tax compliance suite Small business suite. The process can be different depending on the state, and sometimes a fee is required. LinkedIn Facebook Twitter. Quicken import not available for TurboTax Business. I'm tired of complicated tax systems. Turn on suggestions. I see that with Paypal purchases it will work differently "If a buyer in Washington or Pennsylvania state purchases the order via PayPal, Etsy will supply the seller with the sales tax as a part of the payment. Business owners.

Showing results for. You have e every right to collect tax from consumers that purchase from you out of state.. ChenilleBliss Community Member. Did you mean:. Prices subject to change without notice. Savings and price comparison based on anticipated price increase. You are more likely to avoid hobby classification if you run the operation in a businesslike manner, depend on the income from the business, keep precise business records and show a profit in three out of five years. This is the same invoice I keep for my records, which will make it look like I collected the money. JiSTknits Registered Member. A simple tax return is Form only, with no attached schedules. Selling your kid's old bicycle is not likely to cause any tax consequences, but when you sell crafts, vintage or specialty items on websites like Etsy, you must report and pay taxes on your net income. Completely illegal on etsy part. Looking for more information? Avalara offers simplified filing and automated tax calculation solutions for small businesses and ecommerce sellers. If a buyer in one of the states mentioned in this article purchases the order via PayPal, Etsy will supply the seller with the sales tax as a part of the payment. I received an email today from Etsy but it was incredibly vague. There are no charges or fees for Etsy automatically calculating, collecting, and remitting sales tax. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

KentOBead Registered Member. Hi Picket, Etsy will not charge tax on tax exempt items, and with PA sales there is no tax on shipping if the item is tax exempt. The article really doesn't say anything about the tax exemptions within PA like clothes and shoes. I live in PA, so as I just found out that etsy takes care of all the sale tax except if the person uses paypal? Amazon is also How To Make Money Off Amazon Fulfillment Shopster Dropshipping sales tax on behalf of sellers, see more in this TaxJar blog post. Or do I have to write each one down as the sale comes in? No, because you are not collecting or remitting it. I live in PA also and am wondering about how this affects my filing electronically over the phone as I have been doing for years. You have e every right to collect tax from consumers that purchase from you out finding time for side hustle crazy ideas to make money state. I too hope Etsy is going to do the collection for all states Eileen. If a buyer in one of the states mentioned in this article purchases the order via PayPal, Etsy will supply the seller with the sales tax what is the difference from a marketing and affiliate advertisement dynamic producer affiliate marke a part of the payment. Savings and price comparisons based on anticipated price increase. I haven't been able to look at it, but perhaps there is no exemption if the item is sold online? Read blog. Big deal.

They will add tax according to the categories you list in, so if you make items that are tax exempt be sure to list them in the appropriate category. He began a partnership with Avalara in , aiming to shed light on issues important to small business owners and Amazon sellers. See my post a few posts above, they are doing so for WA so I don't see why they wouldn't do it for PA as well. We recommend consulting with a tax professional to best define a tax process for your business. I know Etsy is now collecting and remitting the state sales tax. The collection and remittance of the tax is all on Etsy's shoulders, they are responsible for ensuring the correct amount is charged and if they get it wrong it is their responsibility to cover any discrepancies. WeeEssentials Community Member. I'm moving to PA next month myself. I live in PA also and am wondering about how this affects my filing electronically over the phone as I have been doing for years. Adjust your W-4 for a bigger refund or paycheck. I use efile. EpiclesisConsul ting Community Member. Enter your annual expenses to estimate your tax savings. Now Etsy is collecting the tax and they will pay it, so you no longer have to report it or pay it.

Showing results. Showing results. I'm in the same boat. Prices are subject to change without notice. Customer resources Customer center Events Why Avalara. I'm so confused about this sales tax issue. Or do I have to write each one down as the sale comes in? Turn on suggestions. Another problem is what if you are legally collecting tax for your home state? In the event your return is reviewed by a tax expert and requires a significant level of tax advice or actual preparation, the tax expert may be required to sign your return as the preparer at which point they will assume primary responsibility for the preparation of your return payment by the federal refund not available when tax expert signs your return. Deducting business losses from Etsy sales If you sell on Etsy for profit as a business, you can deduct business expenses like: Cost of materials Advertising Shipping These can be deducted even if they exceed the money your business earned. Hopefully some PA sellers will help you soon. The sales tax will be included in the order information, and the fee for the sales tax will be on your Payment account —including the relevant order number. Ultimately, they should not be charged tax on a affiliate marketing kevin david affiliate marketing business plans taxable in the first place. A simple tax return is Form only, with no attached schedules. But this is simply not true. Turn your charitable donations into big deductions. I need to file after end of June for first half of year and have no clue what to do .

Before this, I had to pay PA sales tax on non-exempt items anyway. The tax your buyers pay won't change. You would include those sales figures in the total figure but not in the taxable sales figures. It all boils down to whether you have nexus, or a substantial connection to a state. SpecialBeauty Community Member. They also confirmed that, since Etsy is the collector, if they get the amounts wrong, they are the ones who pay any shortfall. We are still waiting for clarification. NoFrogsAllowed Community Member. Aside from sales in states where Etsy automatically collects and remits tax, you have a choice as to whether or not to charge it. Sellers do not have to update their sales tax settings in their shop for orders shipped to Washington state or Pennsylvania state in the US. If your income is greater than this amount, then you will likely be subject to an additional Medicare tax of 0. Business expenses if your business is a hobby If your Etsy selling is considered a hobby by the IRS then you cannot take business loss deductions to directly reduce your selling income.

PugcentricPursu its Community Member. Before you start collecting sales tax, you how to start my own business from home make money online fast women have a sales tax permit. It's just broadened to all sellers and not just PA sellers selling to PA residents. Sponsored Link. I'm wondering the same thing. Turn on suggestions. Marketplace sellers. Search instead. BootifulLabels Community Member. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. Sellers do not have to update their sales tax settings in their shop for orders shipped to Washington state or Pennsylvania state in the US. Savings and price comparison based on anticipated price increase. I noticed this thread earlier. Business owners. PA is a wonky sales tax state. I'm a seller in PA. Read the details. Our automation specialists are here to answer any questions you have, click the button below to start a chat.

Latest News From the Editor — June 16, Looking for small business sales tax help? If the buyer uses standalone Paypal, the sales tax will be added to your Paypal Not much clarity. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Compared with Amazon or eBay, Etsy maintains a small-time, homegrown feel, thanks to its emphasis on unique handmade goods. You are more likely to avoid hobby classification if you run the operation in a businesslike manner, depend on the income from the business, keep precise business records and show a profit in three out of five years. Self-employment tax is comprised of Social Security and Medicare taxes — the percentage that would normally be withheld from your paychecks as an employee, plus the percentage your employer would have contributed. Adjust your W-4 for a bigger refund or paycheck. Sellers cannot opt out of Etsy automatically collecting sales tax for items shipped to customers located in the states mentioned in this article. More proof that states should require sellers in their home state to collect taxes from ALL transactions for their home state..